Payroll tax withholding calculator 2023

Then look at your last paychecks tax withholding amount eg. Free Unbiased Reviews Top Picks.

New 2022 Tamil Calendar 2023 Apk In 2022 Tamil Calendar Calendar App Calendar

IRS Form W-4 is completed and submitted to your employer so they know how much tax to withhold from your pay.

. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The Tax withheld for individuals calculator is. That result is the tax withholding amount.

It will be updated with. Tax withheld for individuals calculator. There are 3 withholding calculators you can use depending on your situation.

Your W-4 can either increase or decrease your take home pay. For help with your withholding you may use the Tax Withholding Estimator. This calculator is integrated with a W-4 Form Tax withholding feature.

Ad Process Payroll Faster Easier With ADP Payroll. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. This calculator honours the ATO tax withholding formulas.

2022 Federal income tax withholding calculation. To change your tax withholding amount. 2022 Federal income tax withholding calculation.

IRS Form W-4 is. Use Before 2020 if. Lets call this the refund based adjust amount.

250 and subtract the refund adjust amount from that. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Calculate Your 2023 Tax Refund. The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. 250 minus 200 50. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

Tax Withholding Estimator 2022 - 2023. Multiply taxable gross wages by the number of. Get Started With ADP Payroll.

2022-2023 Online Payroll Tax Deduction. Ad Compare This Years Top 5 Free Payroll Software. 2022-2023 Online Payroll Tax.

Ad Process Payroll Faster Easier With ADP Payroll. The information you give your employer on Form W4. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Start the TAXstimator Then select your IRS Tax Return Filing Status. Ad Find the Best Payroll Service for Your Business Easily Upgrade Your Payroll System.

Choose the right calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. Computes federal and state tax withholding.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. You can use the Tax Withholding. Multiply taxable gross wages by the number of.

Wage withholding is the prepayment of income tax. It is mainly intended for residents of the US. 9 rows 2022 Federal income tax withholding calculation.

Please update withholdings as soon as possible. View Tax Tables and Instructions. 2022 2023 Tax Brackets Rates For Each Income Level Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Ad Compare This Years Top 5 Free Payroll Software. Prepare and e-File your.

Read customer reviews find best sellers. Contact a Taxpert before during or after you prepare and e-File your Returns. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Free Unbiased Reviews Top Picks. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options tax allocations.

Thats where our paycheck calculator comes in. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. All Services Backed by Tax Guarantee.

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul Free Unbiased Reviews. It will confirm the deductions you include on your. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Ask your employer if they use an automated. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Browse discover thousands of brands.

How To Fill Out And Submit A W 4 Form To Your Employer

How To Fill Out And Submit A W 4 Form To Your Employer

Income Tax Rates And Slabs For Rental Income 2022 2023 Haseeb Sharif Advocate

Tax Changes For 2022 Including Tax Brackets Acorns

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

2022 2023 Marginal Federal Tax Rate Calculator

Get Tips On Using Form 1095 A Health Insurance Marketplace Statement To File Your Federal Taxes Healthcare Gov

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

Income Tax Rates And Slabs For Rental Income 2022 2023 Haseeb Sharif Advocate

W Va Revenue Secretary Explains Tax Cut Proposal Wvpb

Income Tax Rates And Slabs For Rental Income 2022 2023 Haseeb Sharif Advocate

Professional W 4 Calculator And Pdf Creator Complete Sign

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Income Tax Poster Psd Template Income Tax Psd Templates Templates

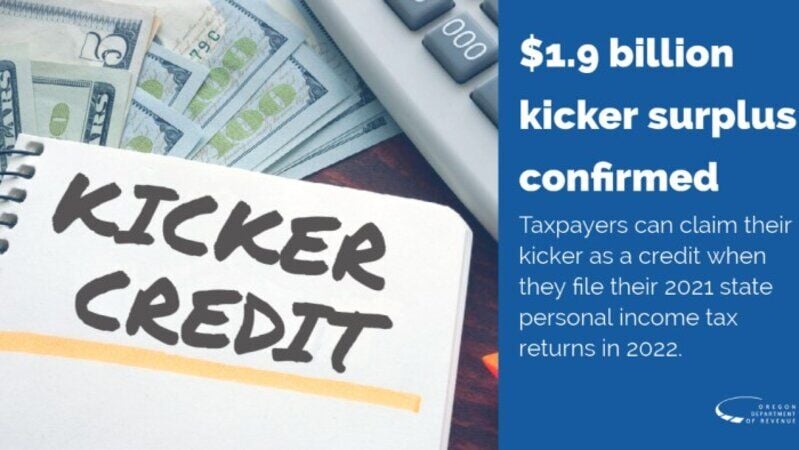

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

5 Things To Do Now To Be Ready For Tax Time